If you have a teen vehicle driver at house, it is much better to have good individual liability coverage with a reduced deductible because brand-new chauffeurs are vulnerable to making errors. Rates to cover teen motorists will automatically be higher because of their lack of driving experience.

Even experienced chauffeurs with past errors, such as moving violations or crashes, may also have to pay higher premiums. Defensive driving training courses help to offset several of the cost (however not all of it) so drive meticulously as well as purposely to prevent paying higher costs. Driving Records as well as Insurance coverage Fees The insurance coverage deductible is inversely proportional to the costs quantity.

This partnership reflects whether you choose to pay basically from your very own pocket before extending your hand to the insurance company. Whichever alternative you select, see to it you can afford it. Some individuals are far better off paying a higher regular monthly premium for a lower insurance deductible to stay clear of any type of large repayments after a crash (cheapest).

Exactly How to Buy Vehicle Insurance policy Picking the appropriate coverage is the very first action to acquiring cars and truck insurance coverage. The next is selecting a great insurer. This can make certain that you're able to obtain the protection you require at the rates you desire while making best use of the opportunities that your cases will be paid.

There isn't much difference in price amongst insurer due to mandates in some states. Yet firms will price quote different costs for similar protection in other states. Lots of tiny insurance provider provide reduced prices contrasted to bigger firms due to their reduced expenses prices. Yet when there is an accident and also an insurance policy claim is submitted, these tiny companies might end up being challenging or uncooperative and tell you particular points aren't covered under your policy.

The Buzz on Will You Waive My Deductible? - Okc Auto Works

cheap car insurance auto insurance car insurance cheap car insurance

cheap car insurance auto insurance car insurance cheap car insurance

However, you can aid prove to your automobile insurer that you're not at fault by taking images with your cell phone, exchanging call info with the various other chauffeur, calling the police, making a cops record, speaking with witnesses, and maintaining an attorney - prices. This process coincides for all insurance provider.

There are various reasons that a car crash can occur, yet there is usually some kind of carelessness entailed (insurance companies). Common kinds of irresponsible driving situations consist of: Speeding up as well as striking another vehicle, Sidetracked driving (texting, talking on the phone, changing the radio, and so on) at the time of the accident, Driving intoxicated (intoxicated, on drugs, and so on)Making an incorrect turn or lane modification and creating a crash, Running a red light or otherwise stopping at a quit indication as well as hitting one more car I Paid My Deductible But the Mishap Had Not Been My Fault, What Should I Do? One means or one more, somebody will certainly have to spend for your insurance deductible from a crash.

If the other driver is at-fault for the automobile crash and you have gathered precise proof from the scene of the accident, filed a police report, as well as got a duplicate of your clinical report, you can show they are at-fault and also recuperate damages from them with an automobile mishap insurance claim negotiation.

If the various other driver or their insurance provider still won't budge, you can take them to test with the aid of your cars and truck accident attorney to recuperate damages - cheap insurance. For How Long Does Deductible Healing Take? It is simple to recuperate your deductible after your automobile was struck by an additional car if you go regarding it properly.

This will certainly verify all the necessary details and also allow the insurance business to collaborate the information of your insurance deductible. To state another method, you will not pay a deductible if the proprietor of the various other vehicle makes an insurance coverage case versus you.

Under Michigan No-fault Insurance Who Pays Deductible? - Truths

Different Kinds of Insurance Coverage Claims After an Automobile Crash If you remain in a car crash that occurs in St. Louis, and also an additional chauffeur was at mistake for the crash, you may submit an insurance claim versus the at-fault chauffeur's insurance company. You can do so because the state of Missouri is a fault-based state when it concerns car crashes (risks).

laws vehicle insurance automobile cheapest auto insurance

laws vehicle insurance automobile cheapest auto insurance

At various other times, the at-fault driver might have insurance policy, however it may not suffice to cover the expenses of your clinical expenses and also other problems. In either of these instances, you might require to rely on your very own automobile insurer if your limits of coverage exceed those of the at-fault chauffeur. insurance companies.

Every one of this clinical treatment can be costly, and in some circumstances, the at-fault chauffeur is totally uninsured or does not have adequate insurance policy protection to compensate you for your injuries. In addition to payment for injuries, you may have experienced mental distress, pain as well as suffering, and other compensable problems as an outcome of your injuries in the accident.

Motorists can also trigger crashes when they are sidetracked or turn their focus far from the roadway, also momentarily. Lastly, motor automobile drivers can cause severe crashes when they are under the influence of alcohol or drugs while they lag the wheel of an auto. The state of Missouri requires electric motor vehicle drivers to carry minimal insurance, some drivers do not prioritize doing so.

When that occurs, the crash target can transform to their own insurance provider and also file an insurance claim for without insurance vehicle driver benefits. The mishap target's insurer can then enter the footwear of the at-fault motorist and give the required insurance protection. An accident sufferer could additionally file a without insurance motorist claim in a phantom automobile crash case.

The Buzz on How Car Insurance Works - Usnews.com

In other words, they are not carrying insurance protection that suffices to make up the crash sufferer for their injuries and other problems. For instance, the crash sufferer might have suffered an irreversible injury that will certainly impact them for the rest of their life, as well as the at-fault chauffeur could only be carrying marginal insurance coverage - liability.

In fact, when you consider submitting an uninsured or underinsured driver claim with your own insurer, the insurer will likely treat you as its worst opponent. Despite the fact that insurer are not intended to strike back by increasing your prices or costs, they can still be difficult to deal with when it comes to working out or prosecuting an uninsured/underinsured driver claim.

Instead, it makes money by accumulating costs from insureds as well as maintaining that cash in-house - cars. Your insurance policy company may try to pay you as little settlement as feasible to settle your without insurance or underinsured vehicle driver insurance claim. That is where an educated as well as knowledgeable St. Louis vehicle crash lawyer at Dixon Injury Firm can tip in and also help.

We can assist you with discussing a favorable settlement in your uninsured or underinsured vehicle driver claim and will certainly function to get you the claim's complete worth. If the insurance provider does not move on its deal, we can litigate the instance in the court system, and also if essential, take it to a jury trial.

The situation will then go through the exploration procedure, much like with any kind of other individual injury instance, and also the issue can resolve at any type of point in the process (insurance companies). If the case does not resolve through the settlement procedure, the parties might choose to take the case to trial and also allow the court determine every one of the questioned issues.

The 9-Minute Rule for Your Guide To Automobile Insurance - State Of Michigan

The experienced St. Louis auto crash lawyers at Dixon Injury Company are just as experienced at the settlement negotiation table as they remain in the court room. Our lawful group will certainly take a look at the very best alternatives for your case as well as aid you pick the one that best fits your demands - perks.

You may be stuck to clinical bills as well as the cost of repair services for a collision that you did not trigger. vans. Having a cars and truck mishap attorney at hand can stop you from having to assume this duty. They can also guarantee you take every required step to hold the at-fault chauffeur responsible for paying your insurance deductible.

See what you might conserve on vehicle insurance coverage, Easily contrast tailored prices to see just how much changing auto insurance can save you. Store around, Although car insurance providers utilize similar variables like age, driving background and also place to calculate your automobile insurance expenses, they consider these elements in different ways.

car cheap insurance liability insurance affordable

car cheap insurance liability insurance affordable

We discovered that costs differ by thousands of dollars a year. In fact, great vehicle drivers with excellent credit can conserve more than $150 a month, generally, by changing from one of the most to the least expensive insurance provider in their state - suvs. And cost savings can be even larger for vehicle drivers with a recent at-fault accident or poor credit scores practically $250 as well as $400 a month usually, specifically.

And also the cheapest firm for a good driver with great credit report might not be cheapest for someone with, state, a DUI or a recent mishap. To decrease your vehicle insurance coverage prices, get quotes from several firms once a year.

The Best Strategy To Use Click here for more info For What Is A Car Insurance Deductible? - Lemonade

Take benefit of cars and truck insurance coverage price cuts, Every insurance coverage business uses unique means to conserve on your cars and truck insurance policy premium. To make sure you're getting all the discount rates you're qualified to, check out your insurance company's discount rates web page and ask your agent to review your possible financial savings (low cost).

If your cars and truck deserves less than your deductible plus the quantity you pay for annual protection, after that it's time to drop them. Collision and also extensive never ever pay out greater than the automobile is worth. Assess whether it's worth paying for protection that may repay you only a small amount (cars).

Put it in a fund for auto fixings or a deposit on a more recent car as soon as your car collapses. See what you could conserve on car insurance, Conveniently contrast personalized rates to see exactly how much switching automobile insurance policy might conserve you. 5. Drive an auto that's inexpensive to insure, Prior to you buy your next automobile, contrast cars and truck insurance policy prices for the models you're thinking about.

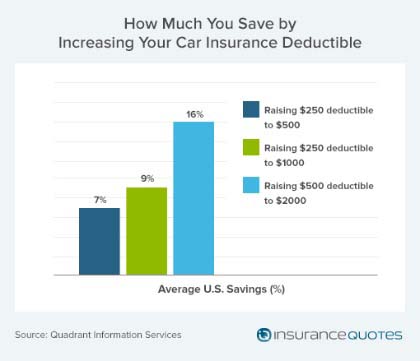

6., the amount the insurance policy business does not cover when paying for repairs. If you have a $500 insurance deductible and your repair work bill is $2,000, the insurance company will pay out $1,500 when you have actually paid the $500.

cheapest car insurance cheapest cheap auto insurance cheaper car insurance

cheapest car insurance cheapest cheap auto insurance cheaper car insurance

7. Enhance your credit score, Your credit rating can be a big aspect when auto insurance companies determine just how much to bill. It can count a lot more than your driving document in many cases. But this isn't the case in California, Hawaii, Massachusetts and Michigan, nevertheless, where insurance providers aren't enabled to take into consideration credit score when establishing rates.

The Single Strategy To Use For 7 Ways To Pay Less On Auto Insurance - The Quad City Herald

It's feasible to get a price cut simply for signing up for a few of these programs, so they may appear like a piece of cake (cheap insurance). Some insurance providers might raise your rates if you're deemed a harmful motorist. Make certain to examine what habits are tracked and exactly how your rate is influenced prior to enlisting.

Comprehending the distinctions between the kinds of coverages that are readily available can help you pick a plan that is right for you. The kind of insurance coverage you require depends upon a range of factors, including the state you live in, whether you have or rent the vehicle, as well as the age of the auto you drive.

This coverage gives compensation for injuries to others, and also for the damages your car does to another individual's property if you cause a crash. auto. If you are found in charge of creating problems as an outcome of an accident, this insurance coverage might compensate to the limit you pick, and it can offer for a legal defense if you're filed a claim against.