Part of the factor why Michigan's insurance is still so high is that some individuals, those without sufficient insurance policy, are still not eligible to decide out of paying for PIP - suvs. Others who are qualified may not realize they can make the adjustment or know just how to do so. To pull out, chauffeurs need to verify that they have actually certified medical insurance and sign a special type for their insurance provider.

Still, some chauffeurs are conscious that they can choose out of spending for medical insurance coverage on their cars and truck insurance coverage yet they are picking to keep it. Take Clinton Territory resident Rainy Lahaie. In September she told WDET, "It's valuable to me." As a nurse, Lahaie says she's seen up-close the benefits of PIP, that it grabs where medical insurance can end and also can cover extensive healthcare facility keeps, pay for first-class rehabilitation solutions and also mobility device ramp setup when necessary.

Trusted, precise, current WDET is right here to maintain you notified on essential details, information as well as sources related to COVID-19. This is a demanding, unconfident time for lots of.

car insured laws insure trucksinsurance cheapest car insurance auto insurance liability

car insured laws insure trucksinsurance cheapest car insurance auto insurance liability

9 WDET, telling the tales about individuals populating the Detroit region as well as the problems that affect us right here.

Fans of Michigan's reform of its no fault auto insurance law in 2019 guaranteed it would certainly lower car insurance premium prices for chauffeurs throughout the state and make insurance for Detroiters, that paid the greatest premiums of any city in the nation a lot more affordable (insurers). The evidence thus far recommends the law has stopped working in a lot of cases to deliver on both assurances.

Not known Incorrect Statements About Detroit And Michigan Lead The Nation With The Highest Auto ...

Almost 36% stated their car insurance policy costs were greater. Customers of one company - People Insurance policy - paid usually $90 more in 2021 than they did in 2019 for car insurance, according to the business's most recent price filing with the Michigan Department of Insurance Policy and Financial Services. Citizens Insurance coverage earnings increased 24% in the 2020-21 monetary year, compared to the fiscal years 2017 with 2019 (cheaper car).

He states the Governor as well as state legislature require to acknowledge that the no mistake reform has actually fallen short to lower insurance expenses for numerous Michiganders, "so it does not simply turn out to be a faucet of cash money to the insurance provider (vehicle)."Heller stated the People Insurance policy price declaring shows an even more uncomfortable concern.

There are more than 18,000 such Michiganders that had actually been receiving life time assistant and also various other treatment from the fund. The brand-new no mistake regulation cuts insurance policy payments to these survivors' long term care companies by virtually half, and many are going out of service. Some survivors have died as an outcome of shedding treatment, and also others have landed in health centers since there was no various other location for them to go.

Personal Financing Insider discusses items, methods, and also suggestions to aid you make clever choices with your cash. We might get a little compensation from our companions, like American Express, but our reporting and suggestions are constantly independent and objective - cheaper car insurance. Terms apply to offers provided on this page. Read our content criteria. According to the Insurance Details Institute, Michigan is the second-most expensive state for in the US, with an ordinary costs of $1,358.

automobile vehicle trucks autocar insured cheaper car insurance risks vehicle insurance

automobile vehicle trucks autocar insured cheaper car insurance risks vehicle insurance

However that doesn't mean you can't find a bargain. It deserves searching and also obtaining quotes from several companies. After that, contrast those quotes to obtain the most insurance policy for your cash. Your driving background, postal code, and even personal factors like marital relationship standing or gender could affect your prices. In the US, chauffeurs have to have obligation insurance coverage.

Indicators on Michigan Insurance Calculator For Auto And Home Insurance You Should Know

Consumer complete satisfaction is defined by 5 aspects: billing process and plan information; cases; interaction; policy offerings; as well as price., a consumer research study business that checks clients, these are the leading cars and truck insurance companies in the North Central area (which includes Michigan): J.D. Power consumer satisfaction positions: Erie Insurance, State Farm, COUNTRY Financial, Met, Life, American Family Members, Auto-Owners Insurance, Progressive, GEICOThe Hanover, Liberty Mutual, Nationwide, Farmers, Allstate, Grange Insurance, Safeco, Travelers, Automobile Club Team, USAA * - Since USAA is just available to military as well as experts it is not consisted of, however it had the greatest rating of all the firms provided, The following are the most prominent cars and truck insurance coverage business in Michigan, based on the percentage of insured Michigan chauffeurs that utilize them: * USAA is only for active military, professionals, as well as their families.

One more method to save is to go shopping around every insurance firm rates policies in a different way, as well as no two plans are the very same. Think about the amount of protection and the kinds of coverage noted on your quote. Keep in mind, you're looking for the most insurance coverage for your cash.

Why is Michigan vehicle insurance so pricey? No-fault laws are among the major reasons Michigan residents see such high car insurance policy rates. In a no-fault state, each chauffeur is repaid for problems by their own insurance provider. In addition, Michigan needs accident protection (additionally called PIP) responsibility, which tends to be costly (vehicle).

TOP CAR INSURANCE PROVIDER FOR DRIVERS WITH DUI: Progressive TOP VEHICLE INSURANCE COMPANY FOR YOUNG DRIVERS: Auto-Owners TOP AUTOMOBILE INSURANCE FIRM FOR MARRIED DRIVERS: Progressive Despite that is at fault in a crash, motorists in Michigan are needed to carry personal injury security (PIP) insurance coverage. Among the major reasons insurance costs in the state are so high is due to this additional obligatory insurance coverage.

vehicle insurance affordable car insurance automobile duiinsurance affordable car insurance insurers vehicle

vehicle insurance affordable car insurance automobile duiinsurance affordable car insurance insurers vehicle

It's normal to recognize that car owners in Michigan are perplexed as to just how they can obtain economical auto insurance coverage in the state without sacrificing appropriate protection. If you just obtained your motorist's license or lately transferred to Michigan, you could be interested concerning the state's automobile insurance policy laws as well as just how to get the finest auto insurance coverage in Michigan - cars.

Not known Details About Erie Insurance: Auto, Home, Life And Business Insurance

Michigan Cars And Truck Insurance policy Laws The state of Michigan has a number of vehicle insurance coverage guidelines that must be complied with. Due to Michigan's status as a no-fault state, a few of these laws are unique to the state. Automobile insurance policy in Michigan is managed as adheres to: In Michigan, all drivers are required by law to bring a minimum amount of car insurance coverage.

Michigan automobile insurance PIP needs After an auto accident, PIP benefits in Michigan will certainly cover your clinical Click here expenditures as well as shed salaries - liability. PIP advantages are paid despite fault due to the fact that of the no-fault law. You don't have to submit a claim versus the at-fault driver because they are paid by your own insurance provider.

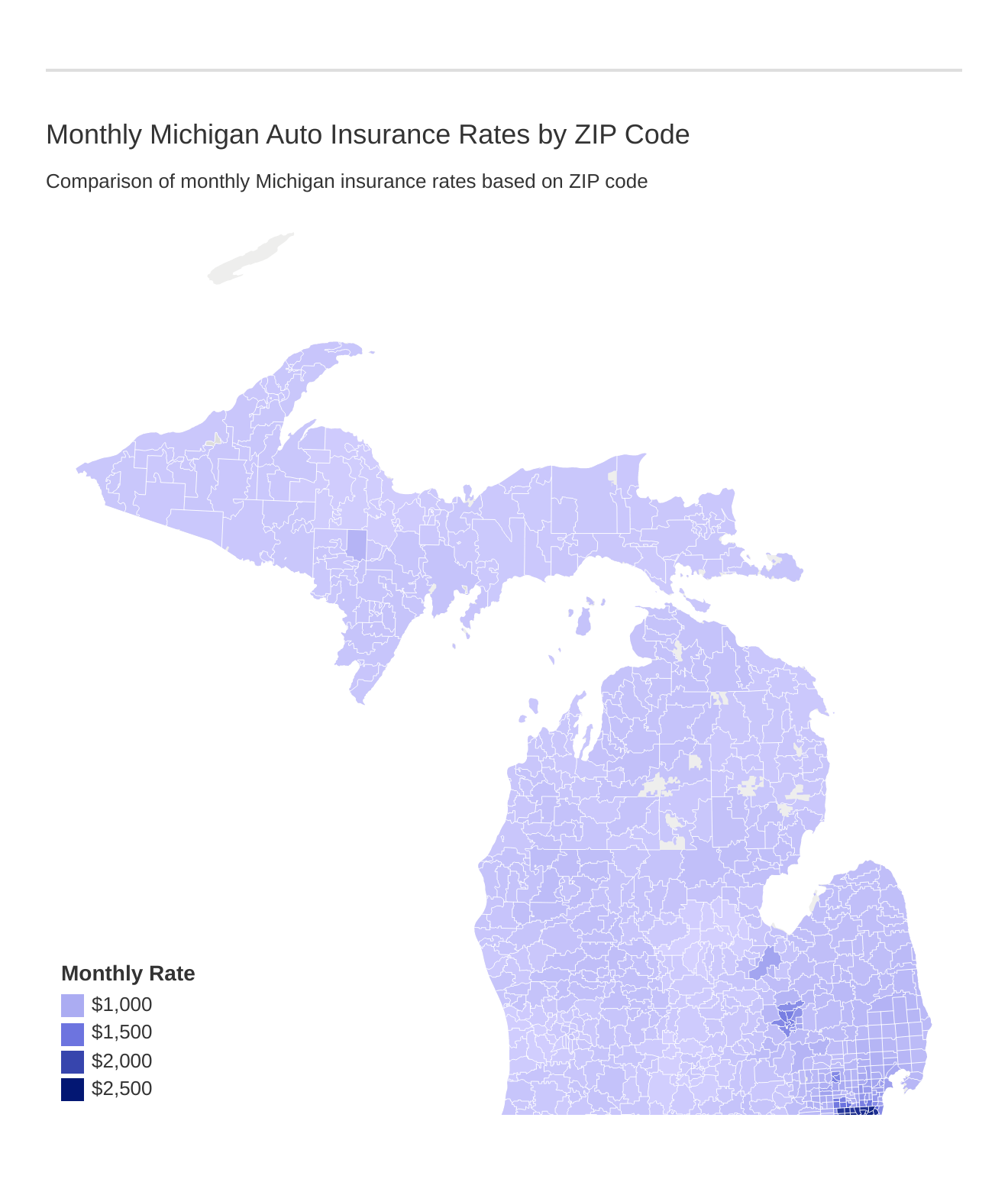

Appropriate proof of insurance remains in the type of an electronic record. Average Cost of Car Insurer in Michigan Vehicle insurance coverage in Michigan is one of the most costly in the nation, with an ordinary costs of $7,175 yearly. Refer the following table to get the numbers of the various insurance coverage quotes.

Cheapest Vehicle Insurance Policy Prices Estimate for Michigan Drivers It's feasible to save cash on car insurance coverage without having to endanger on insurance coverage. Low-cost car insurance coverage is readily available in Michigan from a variety of suppliers. affordable auto insurance. Making use of information on typical annual prices, we found several of the most cost-effective car insurance providers in the state of Michigan.

Lower the quantity you pay for vehicle insurance policy by raising the deductibles. Reduced costs suggest higher deductibles for automobile insurance, and also the reverse is also real.

Getting My Michigan Car Insurance - Reduce Cost On Coverage - Trusted ... To Work

For clients that have two or more insurance coverage with the same firm, a multi-policy discount rate is often offered. Combining your vehicle insurance with your house or tenant's insurance coverage will reduce your premium. Insurers usually charge consumers a regular monthly costs for a six-month strategy, however this is typically a single payment.

A lot of the time, if you change insurers throughout your agreement, the insurance policy firm will refund the unused section of your costs. Automobile insurance coverage discounts are offered from every one of the major insurance firms. Discounts for safe vehicle drivers, excellent trainees, and also automobiles with safety attributes are among the most typical. Sometimes, the price cut will certainly be immediately related to your plan, while in various other situations it will need to be asked for by you.

Insurance fraudulence, litigation expenses, and also high medical care prices are all an outcome of the vast array of insurance alternatives readily available in Michigan. Things to Know Concerning Car Insurance Coverage When Transferring To Michigan Michigan is among the more costly states in the country for car insurance as well as it's a no-fault state.

If you're changing insurance carriers, check regarding change price cuts. Frequently Asked Questions Who has the most affordable auto insurance policy in Michigan? In Michigan, USAA offers the least expensive insurance policy prices for both the state minimum as well as the higher 50/100/50 liability-only insurance coverage.

The 2nd most cost effective carrier with all types of protection is Nationwide. Just how much is cars and truck insurance monthly in Michigan? Auto insurance in Michigan costs a standard of $162 a month, or $1941 a year. Just how much is vehicle insurance coverage in MI? Vehicle insurance policy is costly in Michigan. Michigan's average auto insurance policy premium is $2610 a yearmore than the nationwide average of 82. insurance.

Rumored Buzz on Cheap Car Insurance In Michigan For 2022

Your vehicle insurance coverage costs are much more than just the state in which you live. Why is Michigan vehicle insurance so high? Michigan vehicle insurance coverage is expensive because of 2 elements: the state has no-fault rules, as well as it also calls for unlimited individual injury cover. It can be expensive for those with a poor credit report background or driving records to get auto insurance coverage in Michigan. auto.

Cars And Truck Insurance for Michigan Drivers Michigan vehicle drivers need auto insurance policy coverage that has their back. We're right here to help you find the defense you need to feel positive behind the wheel. If you're trying to find the most effective vehicle insurance policy in Michigan, you'll need to find an insurance provider that exceeds and past for their clients.

At the minimum, ensure to have a duplicate on your phone. Michigan approves digital proof of insurance coverage and also with The Hartford mobile application, we make it easy to constantly have it with you. Download and install the app today by visiting the Google Play or App Shop. Understand that in Michigan, the charges for driving without cars and truck insurance protection include: Fines of $200 - $500 Approximately one year behind bars 30-day license suspension or till you have auto insurance policy Michigan Uninsured Driver Truths The state of Michigan does not need drivers to carry uninsured/underinsured motorist coverage.

Michigan Automobile Insurance Rules for Remaining Safe As you travel with Michigan, there are a number of secure driving regulations suggested to protect you, like:4 Michigan Seat Belt Laws It is a mandatory regulation to wear a safety belt while driving or resting in the pole position of a cars and truck in Michigan - accident.

Michigan Distracted Driving Regulations Texting while driving is outlawed for all motorists in Michigan. Michigan Teen Vehicle Driver Laws Michigan has applied finished licensing legislations to guarantee that young adults gain the experience and maturity required to be secure behind the wheel.

The Single Strategy To Use For How To Get The Most Affordable Michigan Car Insurance

Call The Hartford Regarding Auto Insurance in Michigan Common Questions Regarding Vehicle Insurance in Michigan Exactly How Much is Automobile Insurance Coverage in Michigan? Michigan car insurance coverage rates will certainly be various for everyone, depending on points like your credit rating, driving document and insurance policy ranking - cheapest car. For example, having an at-fault auto mishap can affect your automobile insurance policy rates.